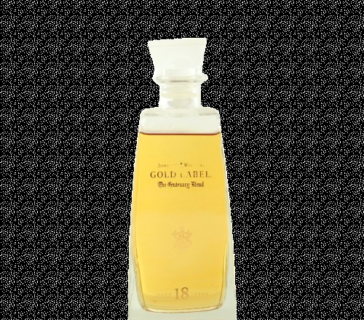

Johnnie Walker Liqueur

75cl / 40%

£299.00

- Region: Scotland

If you like this whisky, you will also like these

The rare, late 1990s expression of blended Scotch luxury, marking an early, discontinued pivot in Diageo’s premium portfolio.

| Field | Details |

| Distillery / Bottler / Country & Region | Johnnie Walker (Diageo) / Scotland, Blended Scotch Liqueur |

| Category | Spirit Drink (Scotch Liqueur) |

| Age / Vintage / Bottled | NAS / Not Stated / Late 1990s - c. 2008 |

| ABV & Size(s) | 35% ABV, 70cl |

| Cask / Treatment | Blended Scotch base, likely honey and fruit infusions |

| Natural Colour | Not stated by the producer |

| Non-Chill-Filtered | Not applicable (Liqueur category) |

| Cask Strength | No |

| Bottle count / Outturn | Not stated by the producer |

| Intended channel | High-end retail, Duty-Free |

| Packaging | Standard Johnnie Walker profile |

| Notes on discrepancies | Not applicable |

Historical Context

The Johnnie Walker Liqueur was introduced in the late 1990s as a strategic experiment to aggressively premiumise the Johnnie Walker brand. The product's foundation rested on a high-quality blended Scotch Whisky base, differentiating it from generic commercial liqueurs. However, the product’s life cycle was relatively short, with production ceasing circa 2008.

The short production window (approximately a decade) resulted in verifiable historical scarcity. The value of the Liqueur today is intrinsically tied to its status as a historical artifact—a strategic experiment that failed to achieve critical mass.

Technical Specification & Variant Map

The definitive technical specification is the 35% Alcohol by Volume (ABV), which confirms its classification outside of the strict regulatory definition of Scotch Whisky (minimum 40% ABV). This lower alcohol content legally permitted the necessary additions of non-spirit ingredients, documented as likely being honey and fruit infusions.

| Product | ABV | Volume | Market | Era Cues | Relative Desirability |

| Johnnie Walker Liqueur | 35% | 70cl | Global, Duty-Free | Launched late 1990s | Moderate (as discontinued historical item) |

Packaging & authenticity checklist

Liqueurs, having added non-alcoholic ingredients, face a high risk of degradation. High-risk indicators that must be meticulously monitored include visible sugar separation, clouding, or crystallisation. Sourcing requires high-fill levels (Into Neck or Base of Capsule) to mitigate perceived risk and avoid significant valuation penalties.

Regulatory/terminology notes

The designation of the product as a 'Spirit Drink' or 'Liqueur' is a legal necessity dictated by the 35% ABV. This classification is essential to distinguish it from the protected category of 'Scotch Whisky'. The category of Liqueur inherently means that terms like Non-Chill-Filtered (NCF) are generally inapplicable.

Liquid Profile (from verifiable notes)

The liquid profile is structured around the foundation of a premium blended Scotch, engineered specifically for smoothness and exceptional sweetness.

- Nose: Expected to present rich notes typical of aged whisky malt, heavily overlaid with distinct sweet honey, soft dried fruit components, and a subtle spice lift.

- Palate: The mouthfeel is notably smooth, possessing a medium viscosity derived from the added sugar content. Immediate delivery of prominent honey sweetness is balanced by mellow oak tannins. The low ABV ensures the flavour delivery is gentle and refined.

- Finish: Medium in length, characterised by lingering sweetness and a gentle warmth provided by the whisky components.

- With water: Counter-intuitive for a 35% ABV liqueur, as it is fundamentally designed for neat consumption or consumption over ice.

Distillery/Bottler Snapshot

Johnnie Walker's globally recognised pedigree ensures immediate recognition and trust in the underlying quality of the base spirit used. This specific bottling provides serious collectors with a unique perspective on the brand’s strategic efforts and portfolio experimentation during the crucial premiumisation push of the late 20th century.

Sourcing

Target formats/eras: Sourcing should target bottles from the defined production era (1990s–2008), specifically focusing on bottles featuring original presentation cases.

Red flags to avoid: The primary concern is liquid integrity. Any indication of sediment, crystallization, or hazy appearance signals product breakdown and renders the item largely unsaleable at premium prices.

Condition thresholds: Sourcing mandates "High Fill" levels (Into Neck/Base of Capsule) due to the heightened risk of degradation.

Margin/velocity expectations: Velocity is anticipated to be low. However, high margins are achievable for bottles in top-tier condition, directly leveraging the verified scarcity factor.